The Finance Ministry recently clarified that reports suggesting Merchant Discount Rate (MDR) on UPI transactions are false and misleading.

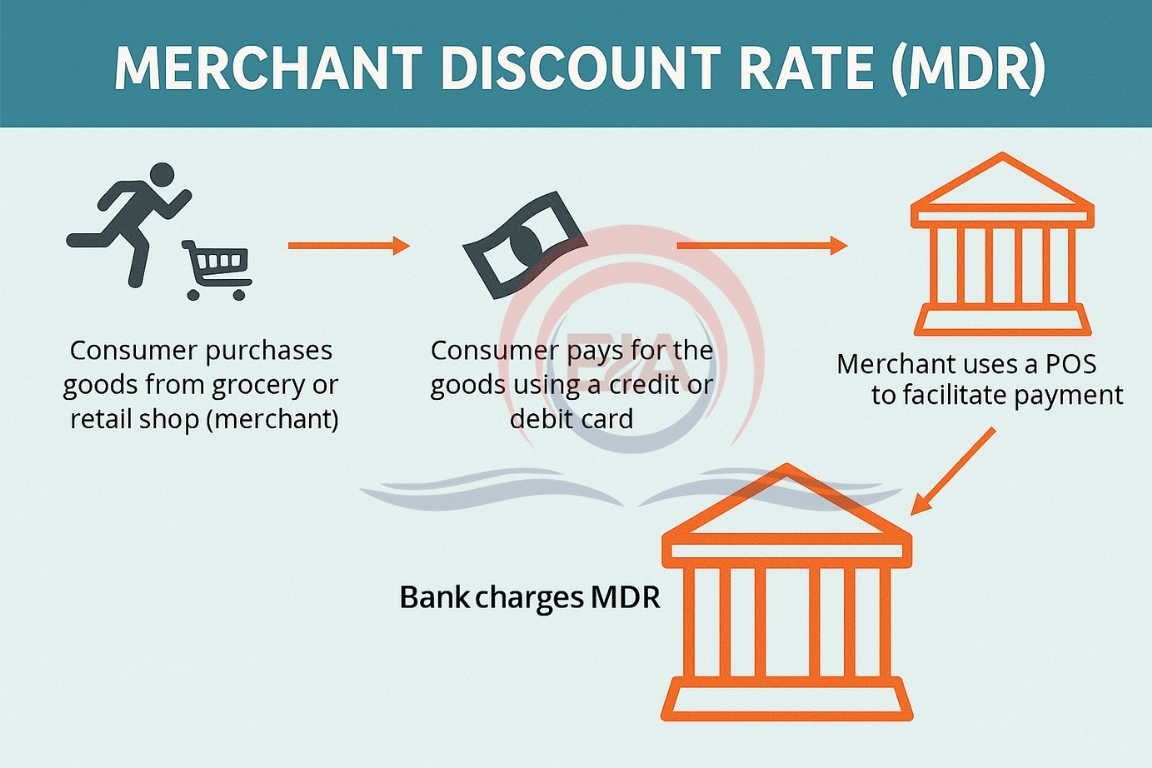

What is Merchant Discount Rate (MDR)?

- MDR is a service fee that businesses pay to banks and payment service providers for processing digital payments.

- It applies to transactions made via credit cards, debit cards, UPI, and mobile wallets.

Who Receives MDR?

- The MDR is shared among:

- Issuing bank (the cardholder’s bank)

- Acquiring bank (the bank that provides the PoS machine or gateway)

- Card network providers (like Visa, Mastercard, RuPay)

- Payment gateways (like Razorpay, Paytm, etc.)

How MDR Works

- It is typically 1% to 3% of the transaction value.

- MDR varies based on:

- Type of card used (debit or credit)

- Volume of transactions by the merchant

- Average value of each sale

- Merchants sign an agreement with banks or payment providers before accepting cards.

MDR and Business Operations

- MDR is deducted automatically from the merchant’s account during settlement.

- Merchants must factor MDR charges into their pricing and cost calculations.

- As per RBI guidelines, merchants cannot pass MDR charges to customers.

NPCI

NPCI (National Payments Corporation of India) is an umbrella organization set up by the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) to operate retail payment and settlement systems in India.

- Established in 2008.

- Developed UPI, RuPay Card, Bharat BillPay, AePS (Aadhaar-enabled Payment System), etc.

- Plays a vital role in promoting digital payments and financial inclusion.

UNIFIED PAYMENTS INTERFACE (UPI)

UPI is a digital payment system developed by NPCI (National Payments Corporation of India).

- It allows people to send and receive money instantly through mobile phones using the internet.

- UPI is linked to your bank account , no need to enter bank details for every transaction.

- You can use UPI apps like Google Pay, PhonePe, Paytm, BHIM, etc.

Conclusion

MDR is an essential part of digital payments, but UPI transactions remain MDR-free for users and merchants, as per current government policy.

PRELIMS PRACTICE QUESTION

With reference to Unified Payments Interface (UPI) and National Payments Corporation of India (NPCI), consider the following statements:

- UPI allows instant fund transfer between bank accounts using only a Virtual Payment Address (VPA), without requiring IFSC or account number.

- NPCI is a for-profit company owned entirely by the Government of India.

- Credit card payments can now be linked to UPI for transactions at merchant outlets.

- UPI operates only during banking hours and does not function on holidays.

Which of the statements given above are correct?

- 1 and 3 only

- 2 and 4 only

- 1, 2, and 3 only

- 1, 3, and 4 only

Correct Answer: A

Explanation:

- UPI allows users to send or receive money using a VPA, eliminating the need to enter bank details or IFSC code.

- NPCI is a not-for-profit company under Section 8 of the Companies Act, promoted by the RBI and Indian Banks’ Association (IBA).

- As per recent updates (2023–2024), RBI has permitted linking RuPay credit cards to the UPI platform for retail payments at merchants.

- UPI functions 24×7, 365 days, even on bank holidays, unlike NEFT.