NITI Aayog released a report titled “Chemical Industry: Powering India’s Participation in Global Value Chains,” outlining strategies to strengthen India’s position in the global chemical sector.

The report highlights current challenges, opportunities, and a roadmap to increase India’s market share in global value chains by 2030.

Overview of India’s Chemical Industry

- India is the 6th largest producer of chemicals globally and 3rd in Asia.

- The sector contributed 7% to India’s GDP in 2023 with a market size of $220 billion.

- Supplies key inputs to agriculture, pharma, textiles, automotive, and construction sectors.

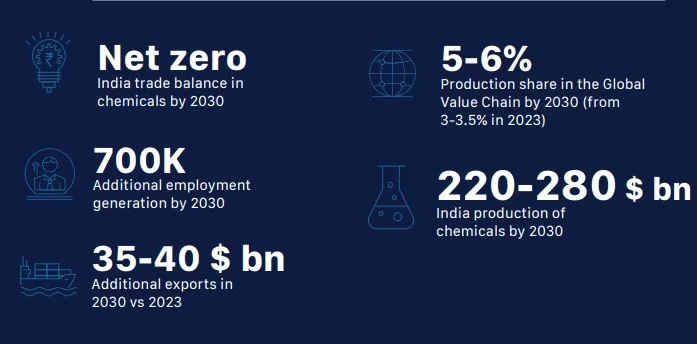

- Expected to grow to $400–450 billion by 2030 and potentially reach $1 trillion by 2040.

- India currently holds only a 3.5% share in global chemical value chains.

Segments in the Industry

- Petrochemicals: Largest segment ($65–75 billion); India has a negative production-consumption balance.

- Specialty Chemicals: High-value, low-volume ($40–45 billion); forms 50% of exports.

- Inorganic Chemicals: Core inputs in construction, electronics, and water treatment ($15–20 billion).

- Other Segments: Includes fertilizers, pharmaceuticals, and personal care ($90 billion).

Major Challenges

- High Import Dependency: India imported $75 billion worth of chemicals (mainly from China), with a $31 billion trade deficit in 2023.

- Weak R&D Investment: Only 0.7% of spending goes into research vs. 2.3% global average.

- Poor Infrastructure: Outdated facilities and high logistics costs.

- Complex Regulations: Delays in environmental clearances.

- Talent Shortage: 30% shortfall in skilled professionals, especially in advanced areas.

- Limited Diversification: Overfocus on bulk chemicals instead of high-end products.

Seven Strategic Interventions

- World-Class Chemical Hubs: Establish empowered central committees and revamp existing clusters like Dahej and Paradip.

- Improve Port Infrastructure: Develop 8 coastal clusters and dedicated chemical terminals.

- Opex Subsidy Scheme: Incentives for increased production based on import and export dynamics.

- Boost R&D & Innovation: Collaborate with academia and industry; bring global technology through MNC tie-ups.

- Faster Environmental Approvals: Introduce deemed clearances and merge regulatory bodies for quick processing.

- Secure FTAs: Negotiate tariff relaxations and feedstock exemptions.

- Skill Development: Upgrade ITIs, create specialized training, and foster public-private apprenticeships.

Learning from China

- China raised its global share from 6% in 2000 to 35% in 2023.

- Focused on infrastructure, innovation, and policy stability.

- India can follow a similar path while adapting it to its federal and economic setup.

Conclusion:

With the right policy push and investments, India’s chemical sector can be a key pillar in achieving the $5 trillion economy vision, enhancing exports, self-reliance, and global competitiveness in green and specialty chemicals.