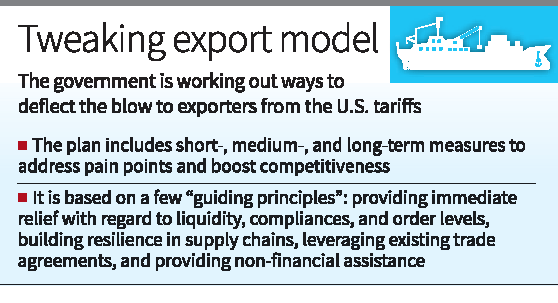

The U.S. has raised tariffs on several Indian exports, creating a liquidity and compliance crisis for exporters. The Government of India has announced a short-, medium-, and long-term plan to provide relief and boost long-term competitiveness.

Background of the Issue

- Tariff hikes by the U.S. have disrupted India’s export order cycle.

- Exporters face delayed payments, cancellation of orders, and working capital stress.

- Labour-intensive sectors and SEZ-based units are at higher risk of job losses.

Short-Term Measures

- Liquidity Relief: Interest subvention, easier access to trade finance, and collateral support.

- Compliance Support: Reduced procedural burden to help exporters sustain operations.

- Employment Protection: Ensuring vulnerable sectors maintain order levels and jobs.

- Tweaks to Export Promotion Mission: Aligning government schemes with current sectoral needs.

Key Schemes Proposed

- Niryat Protsahan: Trade finance assistance through e-commerce export cards, interest support, and easier credit.

- Niryat Disha: Market access measures like branding, packaging, and compliance assistance.

- SEZ Flexibility: Adjustments in policy to help Special Economic Zones maintain production.

Medium- and Long-Term Strategy

- Trade Diversification: Reducing dependence on a single country for export share.

- Leveraging FTAs: Using existing Free Trade Agreements to widen market access.

- Strategic Autonomy: Building resilience in key industries to withstand external shocks.

- Digital Trade Infrastructure: Launch of BharatTradeNet for smoother digital export operations.

HOW TARIFFS AFFECT TRADE

What is a Tariff?

A tariff is a tax imposed by one country on goods imported from another country. It makes imported goods more expensive in the market of the country applying the tariff.

Effects on Trade

Reduced Demand for Imports

- When tariffs increase prices, buyers in the importing country may buy fewer goods.

- Example: If the U.S. puts a 20% tariff on Indian textiles, American buyers will find them costlier and may reduce purchases.

Loss for Exporters

- Exporters in the affected country (India in this case) face fewer orders, delayed payments, or even cancelled contracts.

- Their profit margins shrink, and some may suffer losses.

Shift to Alternatives

- Importers often switch to cheaper suppliers from other countries not facing tariffs.

- Example: Instead of Indian textiles, U.S. buyers may import from Vietnam or Bangladesh.

Impact on Jobs and Production

- Lower exports reduce production in the exporting country.

- This may affect workers’ jobs, especially in labour-intensive sectors like garments, toys, or leather.

Revenue for Importing Country

- The country applying the tariff (U.S.) earns extra money from taxes, but consumers there also face higher prices.

Simple Example

- Suppose India sells steel to the U.S. at ₹100 per unit.

- The U.S. imposes a 25% tariff, making the steel cost ₹125 per unit in the American market.

- U.S. buyers now find Indian steel expensive and may either:

- Reduce imports from India, or

- Buy cheaper steel from another country (say, Mexico).

- Result: India’s steel exports fall, U.S. buyers pay more, and trade volume between India and the U.S. declines.

Conclusion:

The government’s multi-layered action plan aims to shield exporters from immediate tariff shocks while building a stronger, diversified, and digitally enabled export base for the long run.