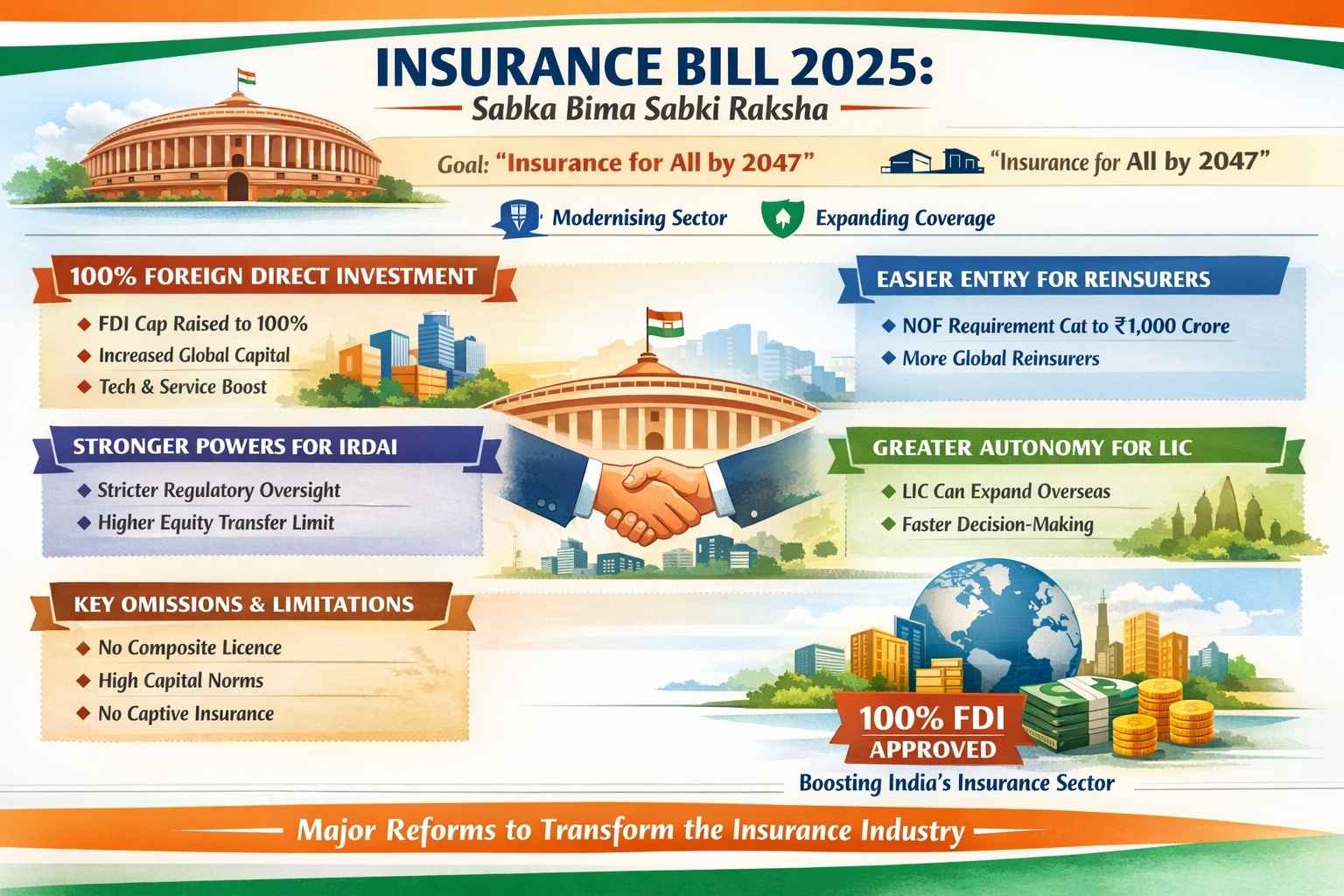

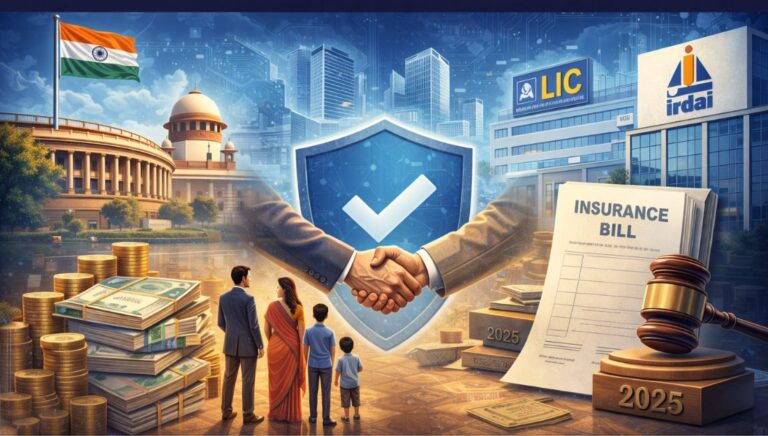

The Union Cabinet has approved the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 for introduction in Parliament. The Bill marks a major reform in India’s insurance sector and is relevant for aspirants preparing governance and economic reforms through institutions such as a UPSC Academy in Hyderabad.

Background

The Bill seeks to amend three key legislations:

- Insurance Act, 1938

- Life Insurance Corporation (LIC) Act, 1956

- IRDAI Act, 1999

The core objectives include:

- Modernising the insurance sector

- Expanding insurance penetration

- Attracting domestic and foreign investment

- Strengthening regulatory oversight

These reforms align with the national vision of “Insurance for All by 2047”, a theme often linked with inclusive growth in GS-II and GS-III discussions at the Best IAS Academy in Hyderabad.

Major Provisions of the Insurance Bill 2025

- The FDI cap in insurance companies is increased from 74% to 100%.

- Expected benefits include:

- Inflow of long-term global capital

- Improved technology adoption and product innovation

- Better customer service and faster claims settlement

- The provision aims to raise India’s low insurance penetration.

Easier Entry for Foreign Reinsurers

- The Net Owned Fund (NOF) requirement is reduced:

- From ₹5,000 crore to ₹1,000 crore

- This move encourages participation of more global reinsurers beyond GIC Re.

- Key benefits include:

- Better risk-sharing mechanisms

- Increased competition

- Enhanced financial stability of insurance companies

Stronger Powers for IRDAI

The Bill enhances the authority of the Insurance Regulatory and Development Authority of India (IRDAI):

- Disgorgement powers to recover unfair gains

- One-time registration for insurance intermediaries

- IRDAI approval threshold for equity transfer raised from 1% to 5%

- Mandatory Standard Operating Procedures (SOPs) and transparent penalty norms

These measures improve regulatory certainty and ease of doing business—important dimensions for GS-II answers discussed in IAS Coaching in Hyderabad.

Greater Autonomy for LIC

- LIC can open new zonal offices without prior government approval.

- It is allowed to restructure overseas operations according to host-country laws.

- The objective is to ensure: Faster decision-making, Greater global competitiveness

No Composite Licence

- A composite licence would allow one insurer to offer life, health, and general insurance together.

- The Bill continues the separate life and non-life insurance structure. This limits bundled products and reduces competition.

Capital Norms Remain High

- Minimum capital requirements remain unchanged:

- ₹100 crore for insurers

- ₹200 crore for reinsurers

- High entry barriers discourage: Small and niche insurers, Regional and rural-focused players

Dropped Reform Proposals

- The Bill does not include:

- Permission for insurers to sell other financial products

- Flexible investment norms

- Allowing agents to sell policies of multiple insurers

No Provision for Captive Insurance

- Large corporations are still not allowed to set up captive insurance companies.

- Captive insurers help firms manage risks internally and reduce insurance costs.

- Their absence delays reforms in corporate risk management.

Conclusion

The Insurance Bill 2025 represents a significant liberalisation of India’s insurance sector through 100% FDI, enhanced regulatory powers for IRDAI, and greater autonomy for LIC. However, the absence of deeper structural reforms—such as composite licensing and captive insurance—limits its transformative potential.

For UPSC aspirants analysing regulatory reforms, federal oversight, and inclusive financial governance through platforms like the Best IAS Academy in Hyderabad, the Bill offers a strong contemporary case study for GS-II answers.

This topic is available in detail on our main website.