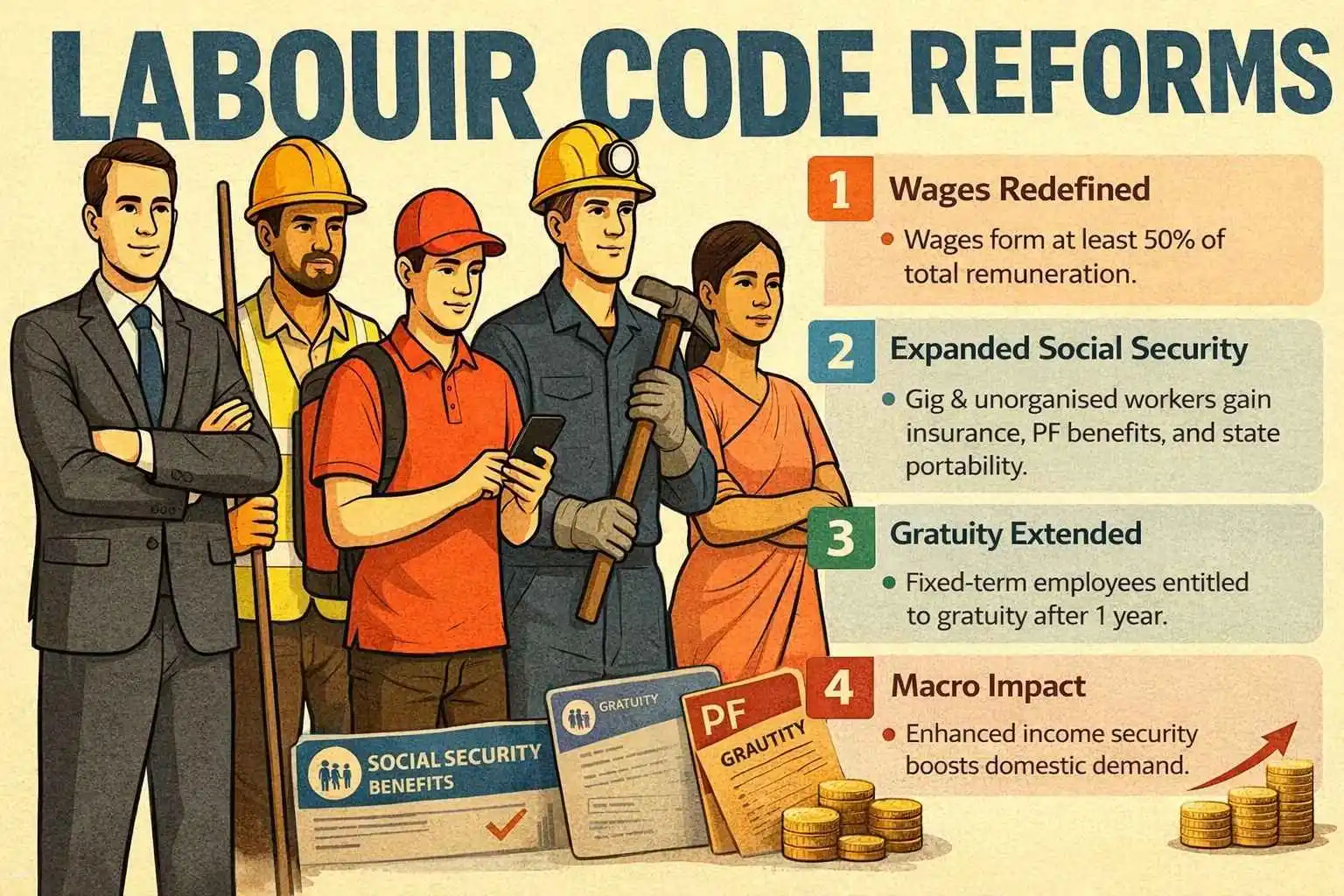

India’s new labour codes have come into effect, redefining wages and expanding social security to organised, gig, and unorganised workers. The reforms aim to modernise labour laws and strengthen financial inclusion and worker protection — a crucial governance reform often analysed in UPSC coaching in Hyderabad.

Wage Redefinition and Social Security

- Wages must now form at least 50% of total remuneration, preventing companies from lowering PF and gratuity contributions.

- This ensures higher PF accumulation, pensions, and gratuity, boosting long-term worker security.

- Fixed-term employees are entitled to gratuity after one year, a major step for contract workers — a significant change discussed in IAS coaching in Hyderabad under labour reforms.

Impact on Corporates and Workers

- Large firms like TCS, Infosys, HCL Tech, and L&T face higher liabilities due to gratuity provisions.

- However, this translates into greater income security and purchasing power for workers, stimulating consumption and savings.

- Redistribution of value strengthens fairness and dignity in employment relations.

Inclusion of Gig and Informal Workers

- For the first time, gig, platform, and unorganised workers are covered under social security.

- Benefits include insurance, PF mechanisms, and portability across states, crucial for migrant workers.

- The Code on Wages ensures universal minimum wages, timely payments, and limits arbitrary deductions, a reform frequently discussed in UPSC online coaching.

Macroeconomic Impact

- Enhanced worker income boosts domestic demand-led growth, unlike shareholder income which often flows abroad.

- Greater savings and financial stability reduce vulnerability to economic shocks.

- Labour codes thus act as instruments of inclusive growth and social stability, a recurring theme in civils coaching in Hyderabad.

Opposition and Reform Context

- Some trade unions oppose the codes, calling them anti-worker, and have organised strikes.

- Critics overlook that earlier labour laws were fragmented and outdated, failing to address modern labour markets.

- Consolidation into four labour codes simplifies compliance, improves transparency, and benefits both workers and employers.

Conclusion

- India’s labour codes represent a structural reform for financial inclusion, extending gratuity, social security, and minimum wages to millions of workers. By redistributing economic value towards labour, they strengthen income security, dignity, and inclusive growth, provided effective implementation ensures workers truly benefit.

This topic is available in detail on our main website.