The Central Electricity Regulatory Commission (CERC) has proposed new rules linking Inter-State Transmission System (ISTS) connectivity to signed Power Purchase Agreements (PPAs). This regulatory shift has important implications for energy governance, often discussed in GS-III classes at leading IAS coaching in Hyderabad institutes.

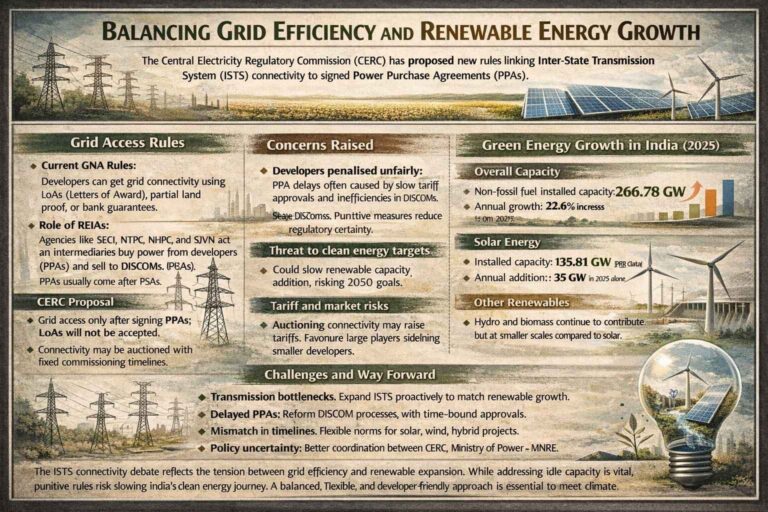

Grid Access Rules

- Current GNA Rules: Developers can get grid connectivity using LoAs, (Letters of Award) partial land proof, or bank guarantees. This allows early project start even before signing PPAs.

- Role of REIAs: Agencies like SECI, NTPC, NHPC, and SJVN act as intermediaries—buy power from developers (PPAs) and sell to DISCOMs (PSAs). PPAs usually come after PSAs.

- CERC Proposal: Grid access only after signing PPAs; LoAs will not be accepted. Connectivity may be auctioned with fixed commissioning timelines.

- Reason for Change: About 31.8 GW has connectivity but no PPAs, and nearly 42 GW projects are stalled due to PPA delays, causing inefficient use of transmission capacity.

Concerns Raised

Developers penalised unfairly: PPA delays often caused by slow tariff approvals and inefficiencies in DISCOMs. Punitive measures reduce regulatory certainty.

Threat to clean energy targets: Could slow renewable capacity addition, risking 2030 goals. Transmission grid (495,000 circuit km) already struggling to keep pace.

Tariff and market risks: Auctioning connectivity may raise tariffs and favour large players, sidelining smaller developers.

These concerns are critical for analytical enrichment in GS-III answers written by aspirants from reputed IAS coaching institutions.

Sector-Specific Issues

- Solar: State-level approval delays; warned against auction-based distortions.

- Wind: Manufacturing cycles longer; opposed 18-month deadline, sought 24–30 months.

- SECI’s View: Auctioning connectivity will raise tariffs; suggested allocation based on readiness (land, finance, equipment).

Challenges and Way Forward

- Transmission bottlenecks: Expand ISTS proactively to match renewable growth.

- Delayed PPAs: Reform DISCOM processes with time-bound approvals.

- Mismatch in timelines: Flexible norms for solar, wind, hybrid projects.

- Policy uncertainty: Better coordination between CERC, Ministry of Power, and MNRE.

- Avoid monopolisation: Allocate based on project readiness, not auctions.

Green Energy Growth in India (2025)

Overall Capacity

- Non-fossil fuel installed capacity: 266.78 GW (up from 217.62 GW in 2024).

- Annual growth: 22.6% increase in one year.

- India crossed the 250 GW milestone of non-fossil capacity in August 2025.

Solar Energy

- Installed capacity: 135.81 GW (PIB data).

- Annual addition: ~35 GW in 2025 alone.

- Solar remains the largest contributor to India’s renewable mix.

Wind Energy

- Installed capacity: 54.51 GW.

- Annual addition: ~5.8 GW in 2025.

- Growth slower compared to solar but remains critical for balancing grid supply.

Other Renewables

- Hydro and biomass continue to contribute but at smaller scales compared to solar and wind.

- India is also expanding green hydrogen projects as part of its long-term clean energy strategy.

Milestones Achieved

- India achieved 50% of total installed electricity capacity from non-fossil sources in June 2025, five years ahead of its 2030 Paris Agreement target.

- The country added 44.5 GW renewable capacity in 2025 (till November), nearly doubling annual additions compared to previous years.

Conclusion

The ISTS connectivity debate reflects the tension between grid efficiency and renewable expansion. While addressing idle capacity is vital, punitive rules risk slowing India’s clean energy journey. A balanced, flexible, and developer-friendly approach is essential to meet climate and energy commitments.

This topic is available in detail on our main website.