The Comptroller and Auditor General (CAG) has released a decade-long review of the fiscal health of 28 states, showing that states’ public debt has increased sharply, creating concerns about debt sustainability and fiscal discipline.

Rapid Growth in Debt

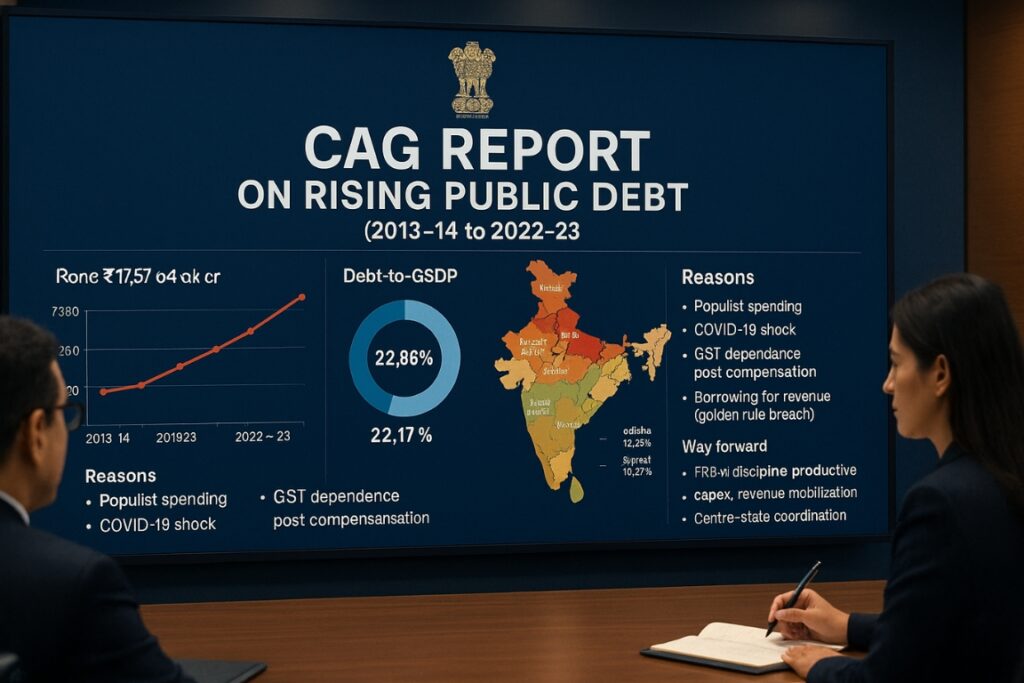

- States’ total debt rose three times from ₹17.57 lakh crore (2013-14) to ₹59.60 lakh crore (2022-23).

- Debt-to-GSDP ratio increased from 16.66% to 22.96% in the same period.

- In FY 2022-23, states’ debt equaled 22.17% of India’s GDP.

State-wise Debt Ratios (2022-23)

- Highest: Punjab (40.35%), Nagaland (37.15%), West Bengal (33.70%).

- Lowest: Odisha (8.45%), Maharashtra (14.64%), Gujarat (16.37%).

- 8 states had debt levels above 30% of GSDP, while 6 states maintained debt below 20%.

Debt vs. Revenue Receipts

- Debt stood between 128–191% of states’ revenue receipts over the decade.

- On average, debt equaled 150% of states’ revenue receipts or non-debt receipts.

Reasons Behind the Rising Debt

- Populist Spending: Free power, farm loan waivers, cash transfers, and revival of old pension schemes funded largely through borrowings.

- Competitive Welfare Politics: States like Punjab, Rajasthan, and Himachal Pradesh have expanded costly schemes.

- Impact of COVID-19: Debt-to-GSDP jumped from 21% in 2019-20 to 25% in 2020-21 due to contraction and emergency borrowings.

- Post-GST Dependence: Loss of independent taxation powers after GST rollout; end of GST compensation in 2022 worsened fiscal gaps.

- Borrowing for Revenue Expenditure: Violation of the “golden rule” — 11 states used more than half of borrowings for salaries, pensions, and subsidies instead of capital projects.

Concerns Raised

- Crowding Out Effect: Higher State Development Loans (SDLs) raise interest rates, affecting private sector borrowing.

- Inflation Risk: Excessive subsidy-driven spending can push inflation.

- Debt Servicing Burden: In some states, 20–25% of revenue receipts go into interest payments.

- Centre-State Fiscal Stress: With Centre’s debt at ~57% of GDP and states at ~23%, India’s total government debt (~80% of GDP) is much higher than the 60% FRBM target.

Way Forward

- Adherence to FRBM Norms: States must align borrowings with fiscal responsibility targets.

- Focus on Productive Expenditure: Prioritise infrastructure, education, and healthcare over subsidies.

- Strengthen Revenue Sources: Improve tax collection, rationalise subsidies, and boost non-tax revenues.

- Centre-State Coordination: Conditional borrowing tied to reforms and transparent debt management can improve fiscal discipline.

COMPTROLLER AND AUDITOR GENERAL (CAG) OF INDIA

CAG is the supreme audit authority in India. It audits all government receipts and expenditures.CAG is a constitutional authority under Article 148 of the Indian Constitution.

- Tenure: Appointed by the President of India for a term of 6 years or until the age of 65, whichever is earlier.

- Reports: CAG submits audit reports to the President or Governor, which are then laid before the Parliament or State Legislatures.

- Functions:

- Audits all government accounts (Central, State, and autonomous bodies).

- Checks if public money is spent efficiently and legally.

- Conducts performance audits to see if government schemes achieve their objectives.

- Independence: CAG enjoys full independence in performing its duties; the salary and service conditions cannot be changed to influence work.

- Significance: Helps in transparency and accountability in the government and protects public interest.

Conclusion

The CAG report highlights that while welfare commitments are important, unchecked borrowing for consumption risks debt sustainability. A balance between fiscal prudence and social spending is essential for long-term economic stability.