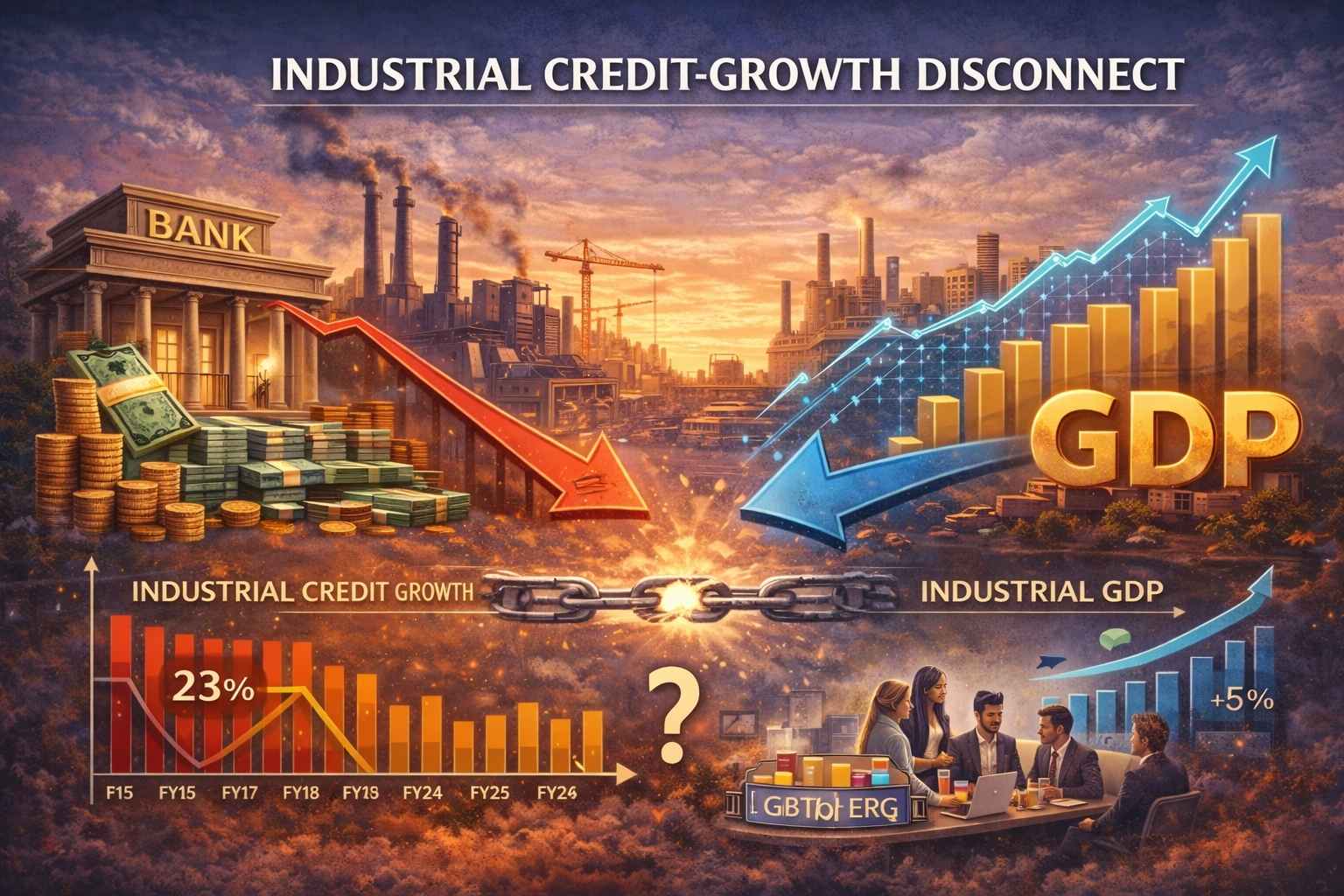

Economists have flagged a significant disconnect between industrial credit growth and industrial GDP during FY17–FY19, raising concerns about the reliability of growth indicators and the effectiveness of credit allocation. This issue has gained prominence in GS Paper III (Economy) discussions among aspirants preparing through UPSC coaching in Hyderabad.

Role of Banking in Industrial Growth

- Banks channel household savings into affordable loans for industries, supporting investment and expansion.

- Industrial credit is a key driver of manufacturing output and GDP growth.

Key Observations

- Declining share of industrial credit: Fell from 42% in 2013 to 23% in 2024, the lowest in 50 years. Services and personal loans gained at the expense of industry.

- Weak credit growth: CAGR of industrial credit was only 4.1% during 2014–24, compared to doubledigit growth in earlier decades. Even excluding pandemic years, growth remained stagnant.

- Regional and sectoral trends: Industrialised regions (west, south, north) grew slower than the national average. No industry group recorded doubledigit credit growth in 2014–24, unlike 2004–14.

- Financial deepening stagnation: Credit/GDP ratio plateaued at 50–55% since early 2010s. Other countries show much higher ratios (China ~1.9, Japan ~1.2).

The Puzzle (FY17–FY19 Disconnect)

- Normally, industrial credit and manufacturing GVA move together (correlation ~0.82 in 2004–20).

- Between FY17–FY19: Industrial credit slowed and manufacturing GVA fell, yet industrial GDP stayed constant.

Implications

- Raises questions about the accuracy and robustness of India’s industrial GDP estimates.

- Points to deeper structural constraints in credit flow to the industrial sector.

- Highlights the need for closer scrutiny of banking practices, industrial demand conditions, and statistical methodologies—topics frequently examined in economy-focused sessions at Hyderabad IAS coaching.

Conclusion

The FY17–FY19 anomaly underscores a serious disconnect between industrial credit and measured industrial growth. With credit to industry stagnating while GDP indicators appear resilient, India must reassess data quality, credit allocation priorities, and industrial policy frameworks. Addressing this gap is essential to ensure credible growth measurement and sustainable industrial expansion, a key concern for aspirants engaging with advanced economic analysis through civils coaching in Hyderabad.

This topic is available in detail on our main website.