A recent RBI bulletin paper revealed that Telangana has the highest per capita UPI transaction intensity in India. The study used PhonePe data to measure UPI usage across states.

UPI Usage Intensity Across States

- Telangana ranks first in UPI usage per person.

- Other states with high UPI intensity: Karnataka, Andhra Pradesh, Delhi, Maharashtra

- These regions have large urban populations, economic hubs, and migrant workforce, boosting digital payment adoption.

Data Source and Coverage

- The study used data from PhonePe, which accounts for: 58% of UPI transaction volume, 53% of UPI transaction value

- This makes it a reliable proxy for assessing nationwide UPI usage.

Shift from Cash to Digital Payments

- Decline in cash demand observed as UPI gains popularity.

- ATM withdrawals as % of GDP have fallen steadily.

- People increasingly use UPI for low-value daily transactions.

Transaction Trends

- Majority of Peer-to-Merchant (P2M) payments are below ₹500.

- Average transaction size is reducing, showing wider daily usage.

- UPI is now dominant for retail and micro-payments.

Regional Variation in Cash Dependence

- Higher cash withdrawal intensity seen in: Northeastern States, Kerala, Goa, and Delhi

- Reasons include: Tourism and service-based economies, Remittance inflows, Rural cash preference

Implications

- Reflects India’s digital payment revolution led by UPI.

- Indicates urban-rural divide in digital adoption.

- Suggests need for: Strengthening digital infrastructure in lagging regions Promoting financial literacy and UPI awareness

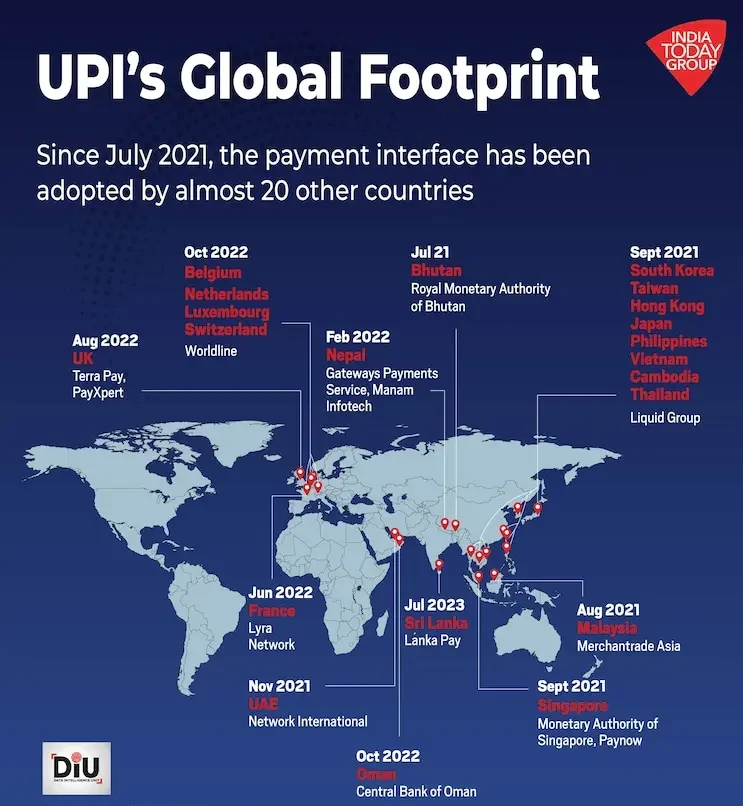

UPI

- Full Form: Unified Payments Interface.

- Launch: 2016 by National Payments Corporation of India (NPCI) under RBI guidance.

- Purpose: Enable instant, real-time, 24×7 interbank payments through mobile phones.

- Features:

- Immediate transfer between bank accounts using a mobile number, virtual ID (UPI ID), or QR code.

- Single platform for multiple bank accounts.

- Supports peer-to-peer (P2P) and peer-to-merchant (P2M) payments.

- Promotes financial inclusion, reduces cash dependence, and encourages digital economy growth.

- Major Players: PhonePe, Google Pay, Paytm, BharatPe.

National Payments Corporation Of India (NPCI)

Established in 2008 under RBI and IBA, NPCI is a not-for-profit organisation that operates retail payment systems in India.

Key Functions of NPCI

- Digital Payment Platforms: Operates UPI, IMPS (Immediate Payment Service), Bharat Bill Payment System (BBPS), AePS (Aadhaar Enabled Payment System), and RuPay Cards.

- Standardisation & Security: Ensures uniform technical standards and security protocols across banks.

- Clearing & Settlement: Handles transaction clearing and settlement between banks for digital payments.

Conclusion

The RBI study highlights Telangana’s leadership in UPI adoption and a nationwide trend toward digital, low-value transactions. Continued focus on inclusion and infrastructure will accelerate India’s shift toward a less-cash economy.