The Ministry of Finance informed Parliament that 15 individuals have been declared Fugitive Economic Offenders (FEOs) till October 31. Out of these, nine major offenders owe Indian banks over ₹58,000 crore, of which only about ₹19,000 crore has been recovered so far.

Background

- Fugitive Economic Offenders (FEOs) are individuals accused of large-scale financial fraud who flee India to avoid prosecution.

- The Fugitive Economic Offenders Act, 2018 empowers authorities to confiscate their assets and recover dues.

- These offenders are linked to high-value scams involving banks and financial institutions.

Scale of the Problem

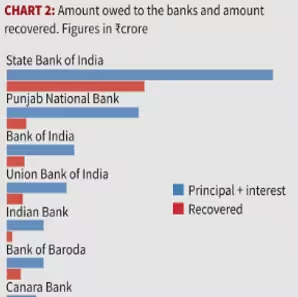

- Total dues: ₹58,082 crore (Principal: ₹26,645 crore + Interest: ₹31,437 crore).

- Recovery so far: Just over ₹19,000 crore (~33%).

- Outstanding amount: Nearly ₹39,000 crore still unpaid.

Bank Exposure

- State Bank of India (SBI): Largest exposure, over ₹22,000 crore.

- Punjab National Bank (PNB) & Bank of India: Significant losses.

- Recovery performance: SBI has recovered ~52% of dues, mainly through liquidation of Vijay Mallya’s assets. Other banks have recovery rates below 40%.

Impact on Public Sector Banks

- Public banks carry most of the burden of these unpaid loans.

- The State Bank of India has the maximum exposure among lenders.

- Punjab National Bank and Bank of India follow in terms of outstanding dues.

Key Offenders

- Vijay Mallya: Tops the list with nearly ₹27,000 crore owed; recovery rate ~56%.

- Sandesara Family (Sterling Group): Owes large sums; recovery rate ~17%.

- Nirav Modi: Linked to PNB fraud; recovery rate ~7%.

- Together, these three account for the bulk of the outstanding dues.

Government Action

- Legal measures: Arrest warrants issued, assets attached under the FEO Act.

- Challenges: Offenders remain abroad, making extradition and recovery difficult.

- Policy focus: Strengthening international cooperation and tightening banking oversight.

Conclusion

Fugitive economic offenders represent a major financial and governance challenge for India.

Fast legal action, foreign cooperation, and stronger banking oversight are essential to protect national wealth.

This topic is available in detail on our main website.