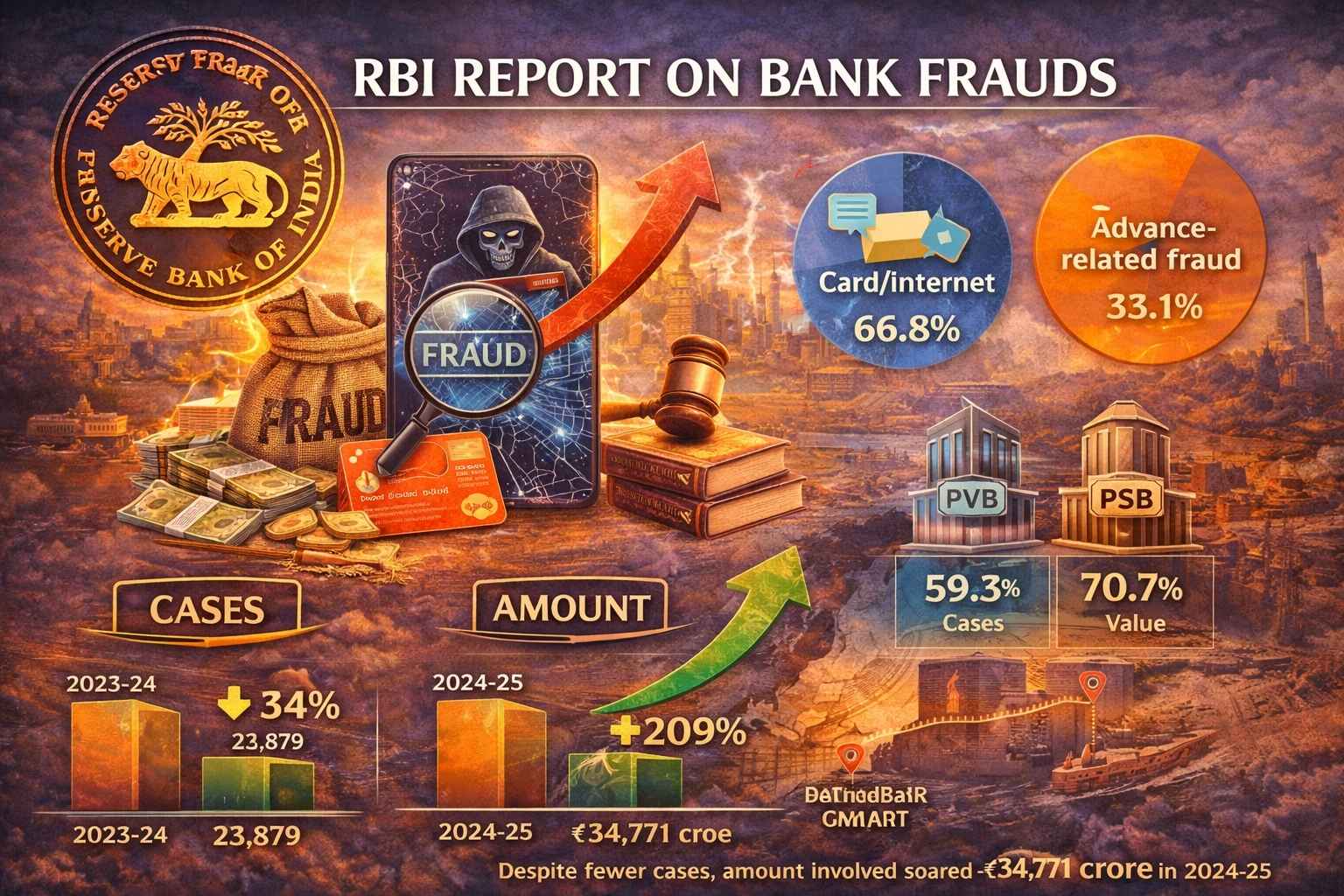

The Reserve Bank of India (RBI), in its Report on Trend and Progress of Banking in India 2024–25, has highlighted a striking paradox in the banking sector: while the number of bank fraud cases has declined, the amount involved has risen sharply. The findings are significant for GS Paper III (Economy) and are closely followed by aspirants preparing through UPSC coaching in Hyderabad.

Findings of the Report

- Cases vs Amount:

- Fraud cases fell to 23,879 in 202425 from 36,052 in 202324.

- Amount involved rose to ₹34,771 crore from ₹11,261 crore.

- Reason for spike: Reexamination and fresh reporting of 122 major frauds worth ₹18,336 crore after a Supreme Court ruling in March 2023.

- Latest trend (Apr–Sep 202526):

- Cases dropped to 5,092 from 18,386 in the same period last year.

- Amount increased to ₹21,515 crore from ₹16,569 crore.

Types of Frauds

- Card/Internet frauds: 66.8% of total cases.

- Advancerelated frauds: 33.1% of total value.

- Private Banks (PVBs): Accounted for most cases (59.3%), mainly card/Internet frauds.

- Public Sector Banks (PSBs): Accounted for most value (70.7%), largely advancerelated frauds.

Banking Sector Resilience

- Despite frauds, commercial banks showed doubledigit growth in deposits and credit.

- Balance sheets expanded, profitability remained strong, and policy rate transmission continued.

Conclusion

The RBI report underscores a critical challenge: fewer fraud cases but significantly larger financial exposure. The trend highlights the urgent need for stronger monitoring, especially of advance-related frauds, improved credit appraisal, and early-warning systems. At the same time, the resilience of the banking sector reflects underlying structural strength. Balancing risk management with growth will remain a key policy priority—an important takeaway for aspirants engaging with economy and banking topics through civils coaching in Hyderabad.

This topic is available in detail on our main website.