The Enforcement Directorate (ED) has recently issued notices to the Kerala Chief Minister in connection with the KIIFB Masala Bond investigation, intensifying the ongoing tussle between the LDF government and central agencies over the state’s financing model.

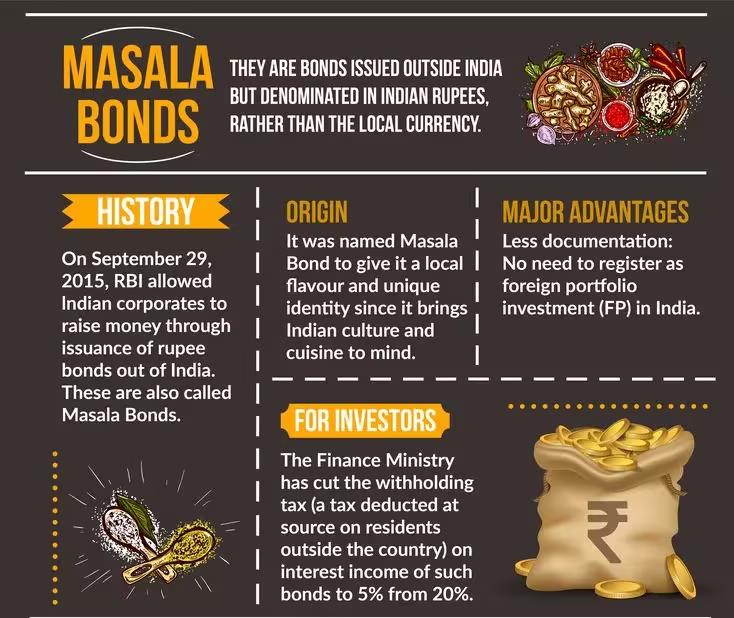

About Masala Bonds

- Masala Bonds are rupee-denominated bonds issued outside India by Indian entities.

- The International Finance Corporation (IFC), part of the World Bank, introduced the first Masala Bonds in October 2013 under its $2 billion offshore rupee programme.

- These are debt instruments that allow Indian companies to raise funds in local currency from foreign investors.

- The currency risk due to exchange rate fluctuations is borne by the investor, not the issuer, reducing risk for Indian firms.

- To compensate investors for this risk, Masala Bonds usually offer higher interest rates compared to those available in their home countries.

- Both government bodies and private companies are eligible to issue these bonds.

Who Can Invest?

- Investors outside India can subscribe, provided they are residents of countries that are members of the Financial Action Task Force (FATF).

- Eligible investors include individuals, institutions, financial organisations, and multilateral or regional institutions where India is a member.

Maturity Period

- For bonds up to USD 50 million, maturity is typically 3 years.

- For larger amounts, maturity can extend to 5 years, offering flexibility to investors.

Use of Funds

- Proceeds are directed towards productive purposes such as affordable housing, infrastructure projects, refinancing rupee loans, or meeting corporate working capital needs.

- Activities like land purchase, stock market investment, or real estate projects are restricted unless specifically approved by the government.

This topic is available in detail on our main website.