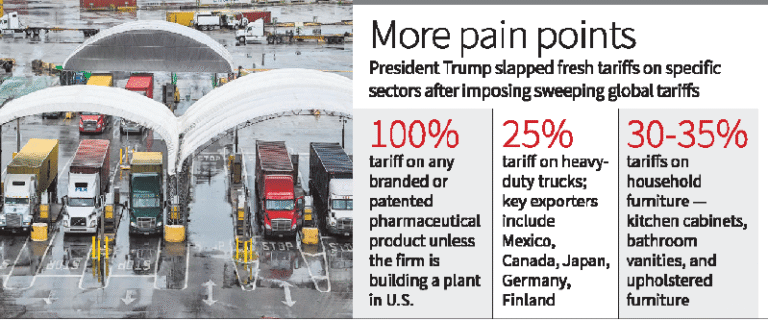

U.S. President Donald Trump has announced a fresh set of tariffs on imported goods, including 100% on branded drugs and 25% on heavy-duty trucks, citing large-scale import “flooding.”

Scope of Tariffs:

- 100% on branded pharmaceuticals, unless the company is building U.S.-based manufacturing.

- 25% on heavy-duty trucks to shield domestic truck manufacturers.

- 50% on kitchen cabinets and bathroom vanities.

- 30% on upholstered furniture.

Justification:

- Claimed as a response to excessive imports from other countries.

- Aims to safeguard U.S. manufacturers and jobs from “unfair competition.”

Implementation:

- Effective from October 1, 2025.

- Unclear if tariffs will be added on top of existing duties.

- No explicit mention of exemptions for trade partners like the EU or Japan.

Strategic and Legal Context

- Trade Tool: Tariffs are being used as a foreign policy instrument to renegotiate trade deals, gain concessions, and exert diplomatic pressure.

- Revenue Implications: Treasury estimates suggest potential revenue collection of up to $300 billion by year-end.

- Legal Safeguards: Moves aim to rely on well-established legal authorities after challenges to earlier global tariffs reached the Supreme Court.

Industry and Economic Impact

- Pharmaceutical Sector: Industry warns that tariffs may disrupt planned investments in U.S. manufacturing. Companies are investing hundreds of billions to localize production.

- Automotive Sector: Protection for U.S.-based truck manufacturers like Peterbilt, Kenworth, and Freightliner.

- Broader Implications: Could affect supply chains, increase import costs, and potentially trigger trade disputes with affected countries.

Ongoing Trade Probes

- National Security Review:

- Dozens of probes are ongoing into imports such as wind turbines, semiconductors, airplanes, copper, timber, and critical minerals.

- Recent probes include PPE, medical devices, robotics, and industrial machinery to assess national security risks of imports and justify future tariffs.

Conclusion

The new tariffs aim to protect U.S. industries and generate revenue, but they may increase import costs, disrupt investments, and trigger trade tensions globally.